Business

Specific Good Tax

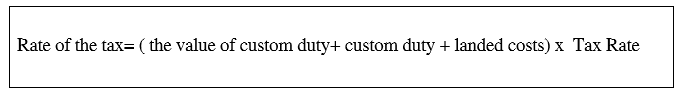

- The following rate is described for the imported goods to local area.

- If the Specific goods are locally produced, the specific goods tax shall be charged on whichever is higher, the sale price mentioned by the factory, workshop or workplace, or the sale price stipulated by the DG and the Executive Committee of the IRD based on the market price.

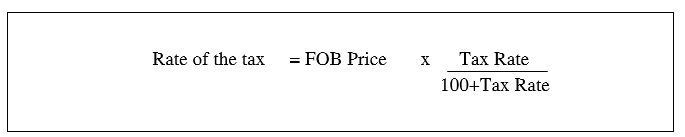

- The following rate is described for the exported goods to abroad.

Commercial Tax

- The commercial tax shall be at 5%.

- The commercial tax shall be 3% on the sale proceeds of the building built and sold.

- The commercial tax shall be 1% on the sale proceeds of Golden Jewelleries.

Income Tax

- While calculating the income, the cost of goods, the expense to make the income and depreciation are deducted from sale proceeds exclusive of commercial tax. The income tax is 25% on the net profit after the deduction.

(How to forecast the tax due is available in the Tax Calculator Link.)